Ninety-one-year-old Gloria Gaynor has spent decades in her Upper Darby home. Now, bedridden and frail, she may soon be forced out of it — not because she couldn’t afford her taxes, her family says, but because of a pandemic-era oversight that spiraled into a legal nightmare.

Last week, Gaynor’s family received notice that the investors who bought her home at a tax lien sale plan to take possession with the backing of the Delaware County Sheriff’s Office. The clock is running, and Gaynor’s daughter, Jackie Davis, is begging for time she fears she no longer has.

“She’s in a hospital bed,” Davis told ABC 7 Eyewitness News. “Are they going to lift the bed up with her in it and take her and put her on the steps?”

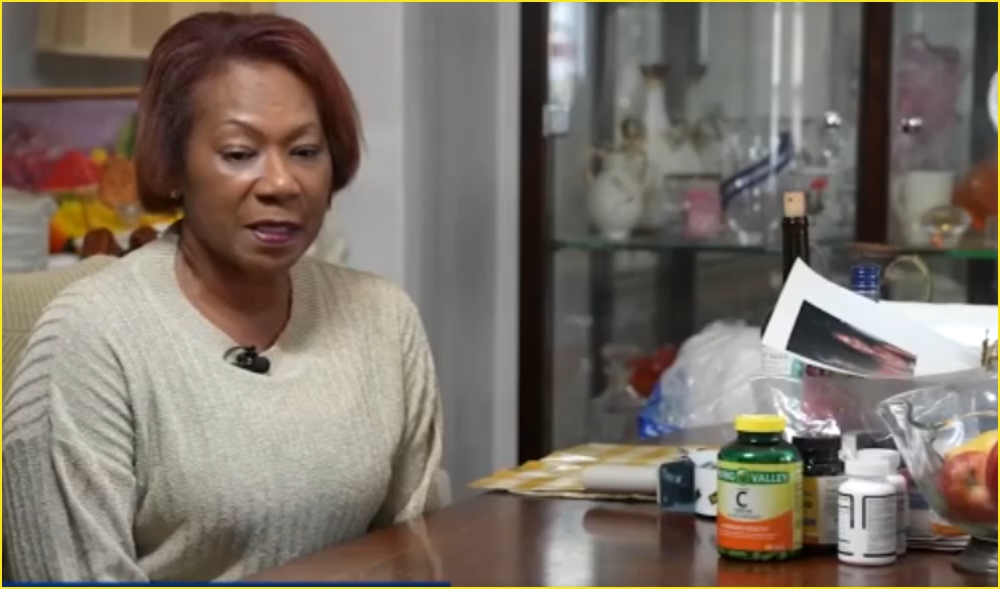

Davis lives in Florida and says she is scrambling to secure a place where her mother can safely live. “I don’t have a proper place for her as yet; so I’m asking for time.”

Gaynor’s case was first highlighted this summer in an Action News investigative report examining Pennsylvania’s tax lien sale system. Her ordeal began in 2020 at the height of COVID-19, when fear of infection kept her from leaving her home, her attorneys say. She missed her property tax payments but had the funds to pay. When she eventually made a payment in 2021, it was not applied to the overdue balance, and the lien proceeded to auction.

Alexander Barth, the family’s attorney, says Gaynor’s case is an anomaly in a system where tax sales usually involve distressed or abandoned properties.

“This is the exception, not the rule,” Barth said. “This is stripping generational wealth from a family. This was a sole asset the mother had to pass on to her children, and there was very little debt on it. Now they’ve lost that.”

The lien was purchased by CJD Group for $3,500 plus fees. Gaynor’s attorneys challenged the sale, citing her age, slight dementia, and the unusual circumstances. The courts repeatedly sided with the buyer. Now, CJD is moving to take possession.

“This is essentially the end game of the situation, unfortunately,” Barth said.

The looming eviction has opened broader questions about responsibility, preparedness, and the unforgiving structure of tax lien laws. Critics note that Davis has had months to prepare alternatives — from arranging assisted living in Pennsylvania to bringing her mother to Florida.

Davis argues her mother would not survive a facility environment and that she needs more time and money to find a suitable home for both her family and her disabled mother.

“I’m praying,” she said. “I hope to luck it doesn’t happen, and I can find a place for her.”

CJD Group and its attorney have not responded to repeated requests for comment.

Delaware County officials explained that the eviction process has not yet formally begun. Mike Connolly, communications director for the county, said in a statement that a Writ of Possession — the document that authorizes the sheriff to remove occupants — has not been filed.

“Once a property is sold at tax sale and the deed is transferred, the new owner determines whether to pursue a change in occupancy,” Connolly said.

He added that the county understands the emotional toll on families but must follow state law.

For now, Gaynor’s fate rests on whether the new owners choose to push forward, and how quickly the courts act. For her daughter, every hour counts.