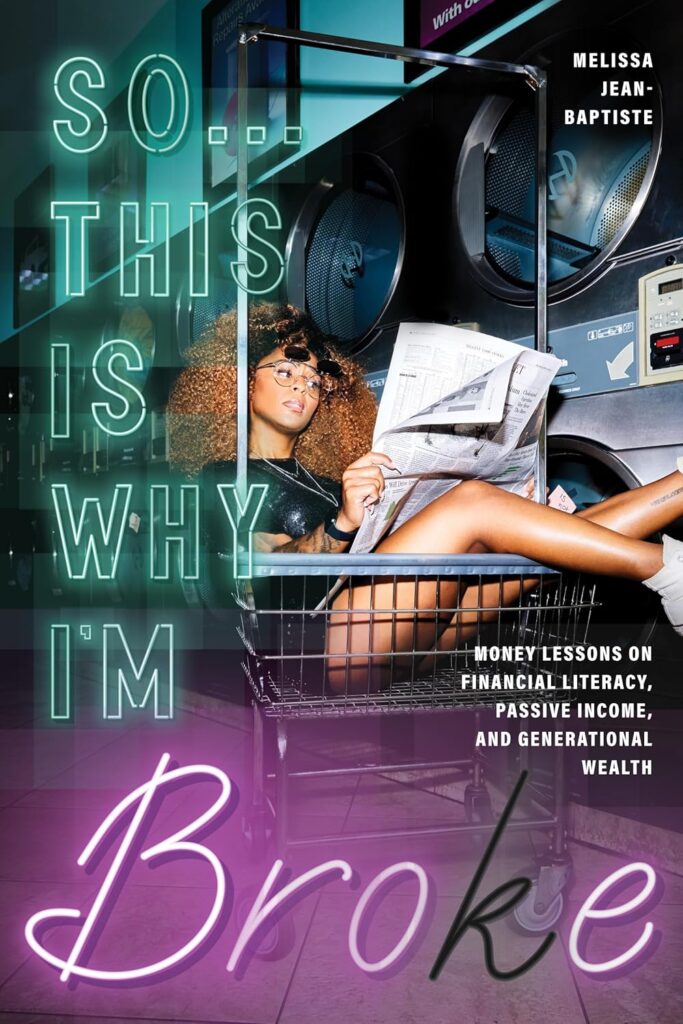

Financial educator and author Melissa Jean-Baptiste, known for her popular book So This Is Why I Am Broke, recently shared her personal journey and the importance of financial education during a powerful interview with ‘Know Your Rights Camp’.

Jean-Baptiste, who overcame significant financial struggles, including the weight of student loans, stressed the critical need for financial literacy, especially in Black and Brown communities.

Jean-Baptiste, a former educator, has been a vocal advocate for mandating financial literacy courses in schools, explaining that this knowledge is essential for empowering marginalized communities to navigate money and build wealth.

In her discussion, she reflected on her own experience at 25, when she was unable to move out of her parents’ home due to the burden of student loan debt.

This challenge motivated her to become financially independent and ultimately led to her becoming a homeowner.

“Every year when I had to make some sacrifices and couldn’t afford to do certain things, it was a reminder that, in five years, I’m going to have my own home,” Jean-Baptiste explained. “Getting rid of my student loans was a big motivation.”

Financial Literacy as a Tool for Empowerment

Drawing on her background as a classroom teacher, Jean-Baptiste passionately advocates for mandatory financial literacy education at the high school level.

She believes that financial education is especially crucial for Black and Brown students, who often face systemic barriers to wealth building.

“I think mandating financial literacy in schools would change the trajectory of so many people,” she said. “I didn’t know what a student loan was, or how interest worked. If I had learned this at 17, I would have been able to navigate money much differently and start using it as a tool.”

Jean-Baptiste also highlighted how racial capitalism and banking disparities disproportionately impact communities of color.

She stressed the importance of equipping young people with the knowledge to recognize and fight against these inequities.

“Understanding the disparities in banking and how to navigate credit allows us to fight back,” she explained. “It’s not always a matter of not having financial literacy or a low credit score—it’s often about inequity within the banking system.”

Actionable Steps for Financial Independence

During her presentation, Jean-Baptiste shared actionable steps for young people to begin their financial journey. She encouraged them to open high-yield savings accounts to start earning interest and to invest in Roth IRAs once they begin working, even if part-time.

“By opening a Roth IRA and investing in low-cost index funds, they can start building wealth right away,” she advised, using a simple analogy comparing index funds to purchasing a whole pizza pie instead of a single slice (a stock in one company).

Jean-Baptiste stressed the importance of financial defense, describing it as the practical action plan that follows financial literacy.

“Budgeting, saving, and investing are ways to protect ourselves financially and grow wealth,” she said.

Her hope is that by arming young people with these tools, they can make informed financial decisions that will positively shape their futures.

A Mission Rooted in Experience

Jean-Baptiste’s advocacy is deeply personal. She knows firsthand the obstacles that come with financial struggles, but her persistence paid off.

Now, she’s dedicated to ensuring that others, particularly in underserved communities, have access to the financial knowledge she lacked.